Global supply chains have endured severe disruptions in recent days as attacks on vessels in the Red Sea have forced some of the world’s largest shipping companies to reroute carriers around Africa. With this resulting in delays to shipments and – potentially – another spike in oil prices, here are the facts you need to know and some steps you can take now to manage the disruption.

What has happened?

The skies over the Red Sea have been the scene of fighting since the outbreak of the Hamas-Israel conflict in October, as US Navy ships in the area have intercepted a number of projectiles fired by Yemen’s Iran-backed Houthi rebel militia towards Israel.

Since then, Houthis have begun attacking ships passing through the Bab al-Mandab strait, a narrow passage on the route to the Suez Canal – hijacking some vessels and bombarding others with drones and anti-ship missiles.

As a result, several major shipping companies – including Maersk, Evergreen and Hapag-Lloyd – have felt they have no choice but to pause their operations through the sea and divert at least some of their ships around the Cape of Good Hope, avoiding the Suez Canal altogether.

While the US and allies are mobilising in the region, supply chains face an indeterminate period of uncertainty and disruption.

What does this mean for supply chains?

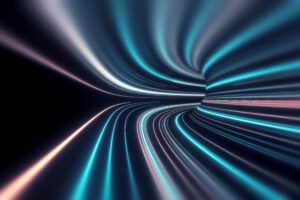

Credit: @typesfast / X

The Suez Canal is one of the world’s busiest shipping routes, with around 12% of global trade and more than nine million barrels of oil passing through the Egyptian channel daily. Its blockage when the container ship the Ever Given ran aground in 2021 was estimated to have disrupted $9.6bn worth of goods each day.

On Tuesday, FlexPort CEO Ryan Petersen shared an image on X, formerly Twitter, demonstrating the scale of the disruption, noting almost one-quarter of all container ships (highlighted yellow above) have diverted.

Maersk’s CEO Vincent Clerk told CNBC on Tuesday that depending on the specific route, sending ships around southern Africa could add “anywhere between two and four weeks of delays.”

As well as delaying the receipt of goods and materials, the crisis is pushing up the cost of shipping, with rates up 4% in the past week.

Clerk said: “It’s a stark reminder just a short time after Covid-19 that disruption to supply chains is still with us and it’s certainly reviving a lot of conversations we’re having with our customers about how to create more resilience in the supply chain.”

What about the price of oil?

The disruption is also providing a fresh jolt in energy prices as the canal is a key route between the oil-rich Gulf states and Europe. Brent Crude, the global oil benchmark, topped $80/barrel on Wednesday, up 1.1%, following a similar rise on Tuesday.

While this could present some short-term turbulence, prices are still below recent highs of $90+ recorded in September amid production slowdowns by Opec and Russia.

“As long as production is not threatened, the market will eventually adjust to changing supply routes,” Ole Hansen, an analyst at Saxo Bank, told Reuters.

What should procurement do?

This is only the latest in a series of massive disruptions experienced by global supply chains over the past few years. From the Covid-19 pandemic to Russia’s invasion of Ukraine, procurement teams now have a breadth of experience to draw from to manage the impact.

Some key insights from the PL community over the past few years have included:

- Understand the impact: Proactively track shipments to understand which materials are likely to be delayed, and work with colleagues to determine the likely operational impact and whether internal plans need to be rescheduled.

- Don’t be afraid to overcommunicate: Whether it’s keeping in contact with suppliers to stay on top of shipments and ensure supply resilience, or updating internal stakeholders in the loop about delays, ensuring a constant flow of information is vital to coping with disruption.

- Think about the bigger picture: Even if you don’t have a supply chain running through the Suez Canal, it’s worth considering the potential wider impacts of the crisis – especially if it is not resolved soon – whether that’s higher inflation due to shortages and fuel costs, or an escalation of conflict in the Middle East.